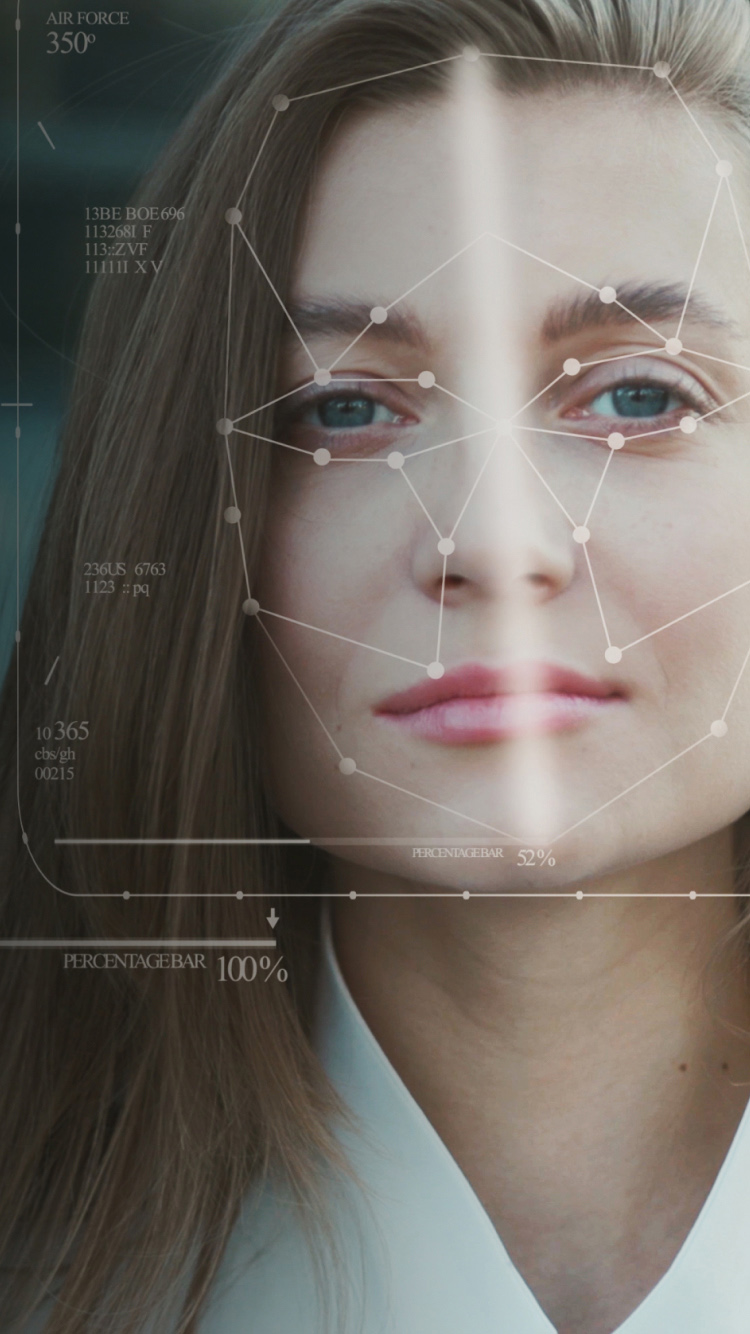

METSAKUUR COMPANY's

facial recognition technology is changing our daily lives.

Commercializing the face authentication system for the first financial sector mobile banking in Korea

Technology supply to the government's mobile driver's license project

Business Customization Services

Optimized for your business environment

Dedicated middleware support for customized bio-certification

Featured Technology

3 key technologies for facial recognition

Officially certified for Accuracy · Processing speed · Safety

1:10 million comparison

Certified by KOLAS

Accuracy of facal recognition

Certified by KISA

Fake prevention technology test

Verification of 13 mobile devices, the only one in Korea

Business Field

In the most critical areas where trust is essential,

METSAKUUR's technology is being implemented.

Business Field

In the most critical areas where trust is essential,

METSAKUUR's technology is being implemented.

-

Login·Convenient Authentication·Mobile OTP

Login·Convenient Authentication·Mobile OTPMobile Banking Facial Recognition

- Supplying the first mobile facial recognition system in the domestic leading financial institution

- Instant facial authentication within 1 second on the mobile banking app

- Expansion of various self-verification features such as login, certificate, OTP, etc.

- Multi-channel facial recognition system expansion for offline counters, ATMs, etc.

-

Account Opening, Card Issuance

Account Opening, Card IssuanceNon-face-to-face ID verification

- To prevent identity theft within non-face-to-face services, compare ID card photos with facial photos

- Possible integration with OCR and ID card authenticity verification solutions

- Financial Payment Institute recommends adoption of facial recognition to strengthen identification for non-face-to-face financial services

-

Internal Authentication, Work from home, ODS (Office Data Security)

Internal Authentication, Work from home, ODS (Office Data Security)Internal system access control

- Internal authentication, work from home, and ODS through self-verification

- Security features such as automatic screen lock when detecting seat departure, other person detection, and screen capture camera detection

- Equipped with Anti-Spoofing technology for preventing abnormal behavior and unauthorized use

- Recommended introduction of biometric authentication by the Financial Payment Institute to prevent internal embezzlement and data leakage incidents.

-

Non-face-to-face Online Exam Cheating Prevention

Non-face-to-face Online Exam Cheating PreventionOnline Exam Monitoring Platform

- Online exam monitoring platform for preventing cheating and enhancing fairness in non-face-to-face online exams

- Applicant self-verification through facial recognition

-

Monitoring of misconduct through 3-channel recording

(Webcam - front, Smartphone - side, Exam screen) - Real-time detection of misconduct, seat departure, other person detection, concentration analysis, etc.

- Web browser-based SaaS service

-

Large-scale People Access Control

Large-scale People Access ControlFacial Recognition Access/Attendance Management Platform

- Optimized solution for companies requiring efficient access management for a large number of individuals

- Streamlining daily worker contracts, including self-verification through mobile, to reduce management personnel and save labor costs associated with waiting times

Facial Recognition Solution

A centrally managed face authentication platform that

provides integrated solutions customized for your business.

News · Media

We will provide you with the latest news

from METSAKUUR INC. as quickly as possible.

Client · Partners

We work in a variety of industries,

with a focus on financial and public industry.

Contact Us

We offer customized services to drive innovation in your business.

- We provide consultation on service models customized to your business type.

- We will promptly contact you upon confirming your inquiry.